R&D Credit Calculation Alternative Simplified Method

Content

It’s calculated on the basis of increases in research activities and expenditures—and as a result, it’s intended to reward companies that pursue innovation with increasing investment. You must be seeking to advance products or processes within your industry. There are no limits on how large or small a company you need to be to claim the tax credit. However, you do need to justify your qualified research expenses and carefully document the expenses and activities. Eligibility is complex, so make sure you hire a professional.

Section D only requires completion from taxpayers making the payroll tax election for their small businesses. Designated small businesses can apply as much as $250,000 of research credits to offset payroll tax obligations. It’s available at the federal and state level, with over 30 states offering https://kelleysbookkeeping.com/ a credit to offset state tax liability. Even unprofitable startups can likely decrease their burn rate using R&D tax credits – they are offsets to payroll taxes that all companies with payroll in the US pay. As such, the ASC method is often a popular alternative to the Regular method.

Sales & Use Tax Client Success Story

However, because the maximum corporate tax rate was reduced from 35% to 21%, the AMT rate was eliminated, and taxpayers will see an increased credit. As a first step, a company should review its operations for eligible activities. Companies that go on to claim the credit must also be prepared to identify, document, and support their qualifying R&D activities. A company must demonstrate—through How The R&d Tax Credit Is Calculated modeling, simulation, systematic trial and error, or other methods—that it has evaluated one or more alternatives for achieving the desired result. Some activities naturally follow an iterative trial and error process. For example, engineering, software development, or clinical research activities all rely on a process that can evaluate one or more alternatives.

What are the four criteria for R&D tax credit?

The qualifying activities must constitute the process of experimentation involving: simulation; evaluation of alternatives; confirmation of hypotheses through trial and error; testing and/or modeling; or refining or discarding of hypotheses.

Despite all these opportunities, most taxpayers continue to underreport potential qualified research expenses . We are able to walk you through the R&D process and assist you in navigating common misconceptions. For either calculation method, a portion of the R&D credit can be used to offset up to $250,000 in employer social security payroll expenses, but only for certain companies. To qualify, an eligible small business must have no more than five years of gross receipts and less than $5 million in gross receipts for the year the R&D credit is being claimed. In this case, the R&D credit carryforward must be adjusted to account for the amount of payroll tax credit claimed.

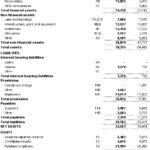

Step 2: Average Your Gross Receipts

Compute one-half of the average QREs to determine the base amount for the current tax year. If you believe you may qualify for the R&D tax credit, please contact us to learn more. 20% of the excess of “basic research payments” (or “university basic research payments”) made in the current year over a base amount paid to universities and other qualified organizations. The base amount is the average of the prior three years’ payments for “basic research” to qualified organizations. The summation of qualified wages, supplies, and contract expenses is referred to as total “qualified research expenditures” or “QRE”.